Planning for Your Digital Assets

An estate plan often focuses on property such as financial accounts, jewelry, real estate, and vehicles. However, in this age of technology, it is important to remember to include your digital assets. Planning for your digital assets can help ensure they pass to your loved ones, instead of getting lost in the cloud simply because no one knew about them. Also, by including them in your plan, you can better secure your information and prevent identity thefts.

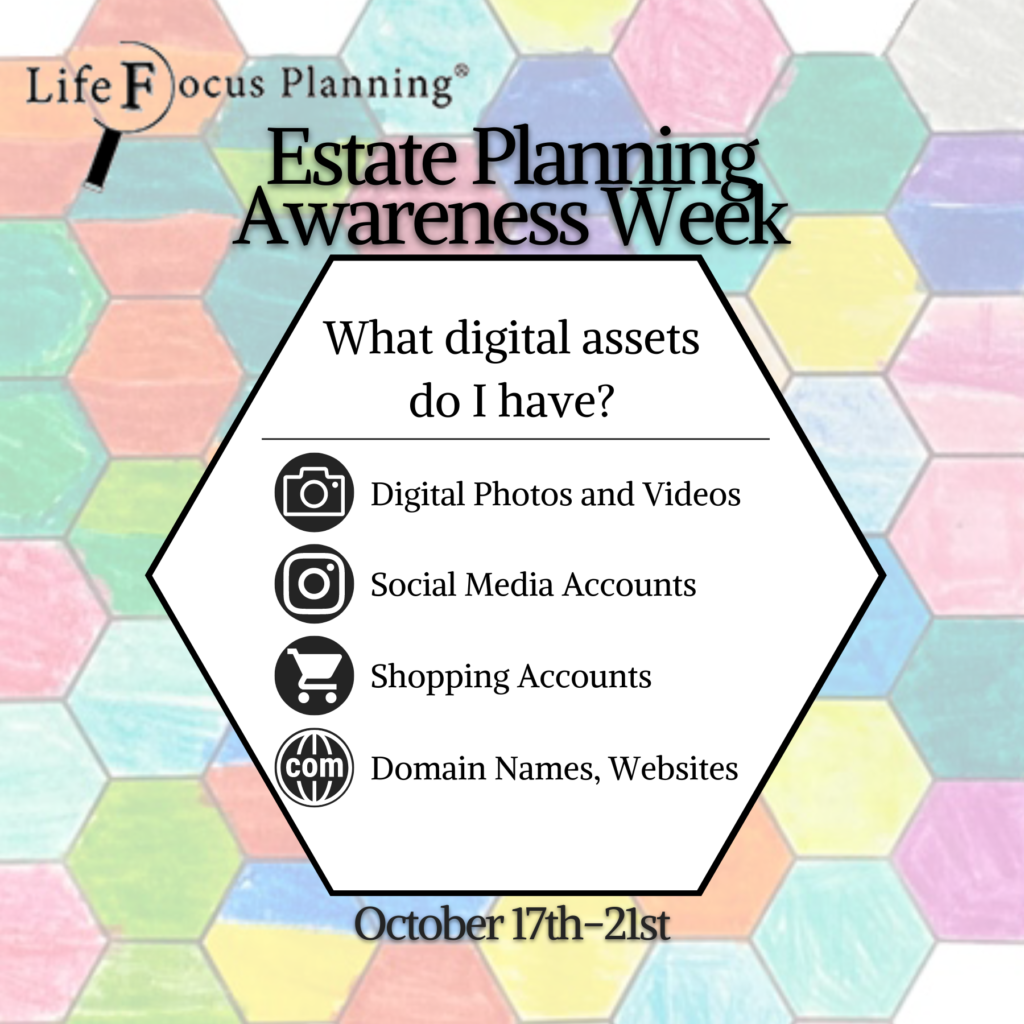

Your digital legacy can be broken down into four main categories: personal, social, financial, and business. Personal assets would consist of your family photos, videos, and even recipes. Preserving these for sentimental reasons can add to the legacy you pass down to your loved ones. Social assets are your social media or email accounts. Certain accounts, like Facebook, are able to be turned into a memorial account after you pass away or they can be taken down altogether. But you have to plan for what you want to happen at your death. Financial assets can include online shopping accounts, virtual or cryptocurrencies, loyalty and reward accounts, airline miles, online betting accounts and more. Business assets can include domain names, websites, or intellectual property. It’s important that your loved ones know these assets exist and are able to access them after your gone to manage them, distribute them appropriately, or close the account down properly.

Just as any other asset, you should have a plan for your digital assets so they are either preserved and added to the legacy you leave, or protected for the loved ones you pass them on to. Contact our office for a complimentary initial consultation at (248) 409-0256 to include your digital assets in your estate plan.